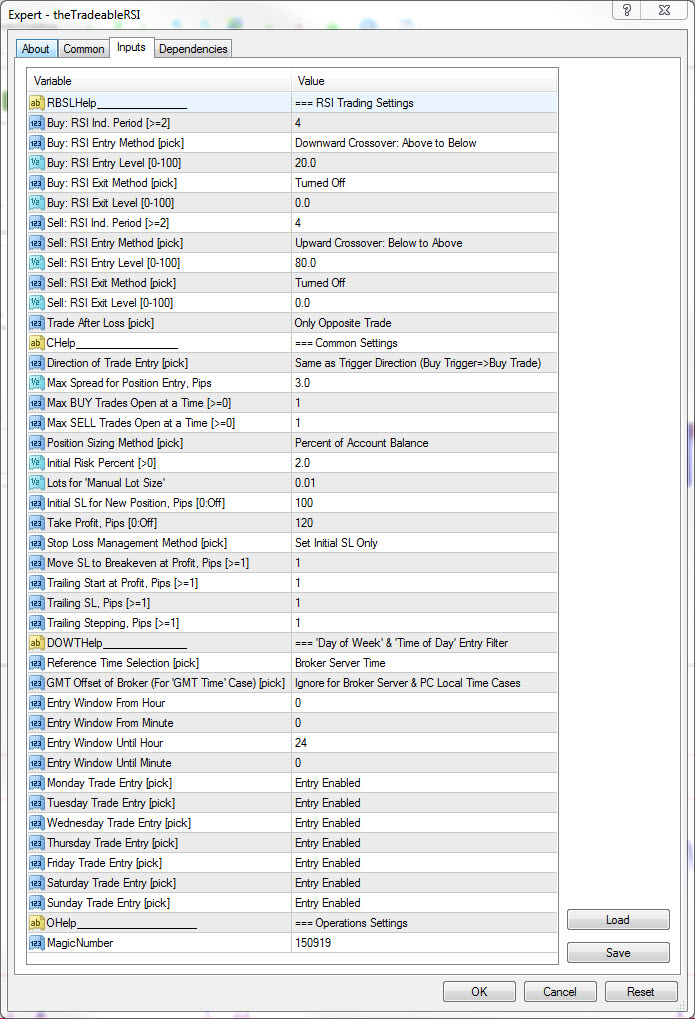

Possible Swing trading strategy (strategy 1)

Swing trading Strategy 1

- Use the 4 hour timeframe and the USDEUR

- Use a 4 RSI period setting

- Buy when the RSI closes under the 20 level for the first time and SELL when the RSI closes above the 80 level for the first time

- Use 120 pips as the Take Profit and 100 pips as the Stop Loss

- Risk 2% on every trade based on account balance

- Ignore other settings and filters

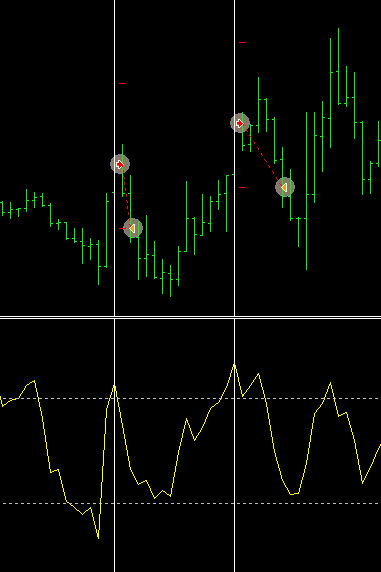

An example of trades using Strategy 1

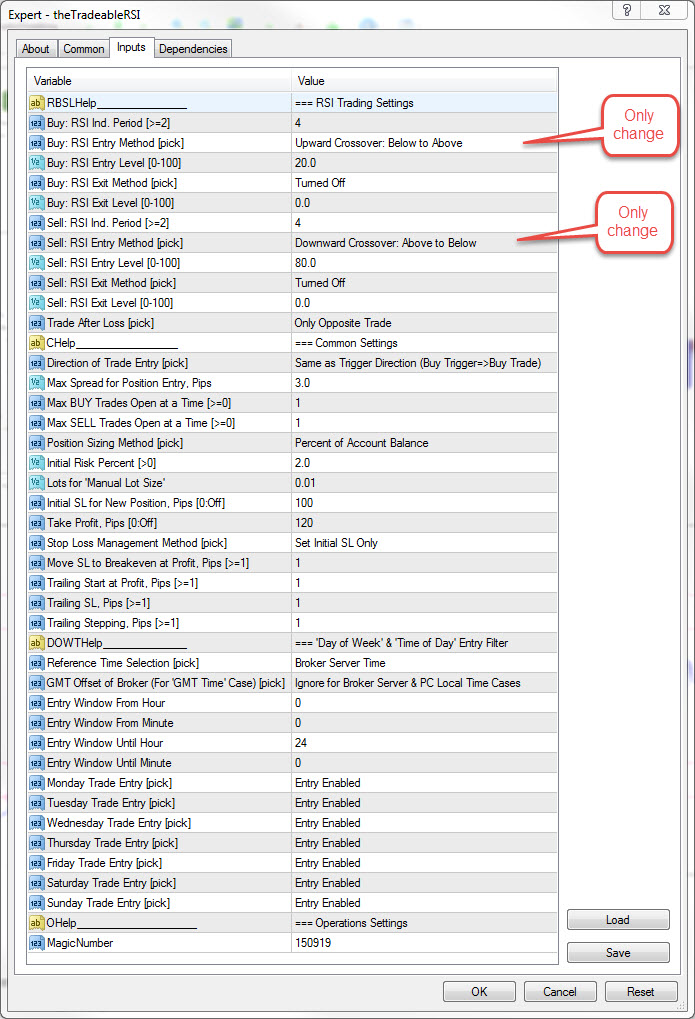

Possible Swing trading strategy (Strategy 2)

Potential Swing trading Strategy 2

- Use the 4 hour timeframe and the USDEUR

- Use a 4 RSI period setting

- Buy when the RSI closes above the 20 level for the first time after being oversold and SELL when the RSI closes below the 80 level for the first time after being overbought

- Use 120 pips as the Take Profit and 100 pips as the Stop Loss

- Risk 2% on every trade based on account balance

- Ignore other settings and filters

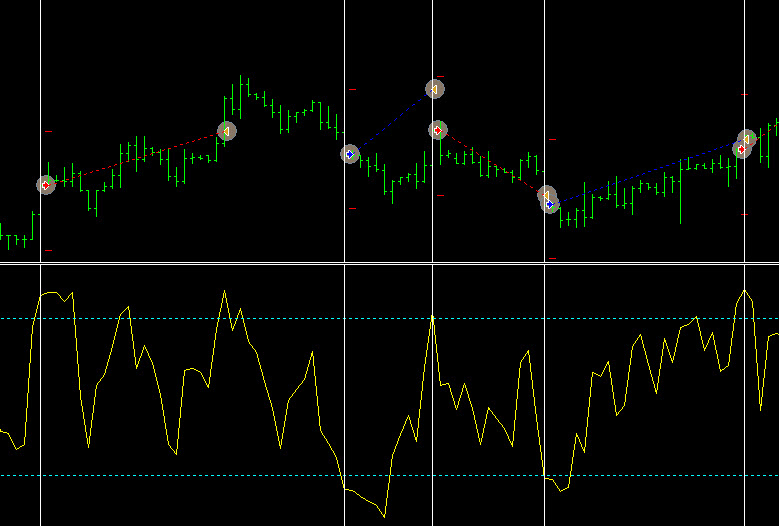

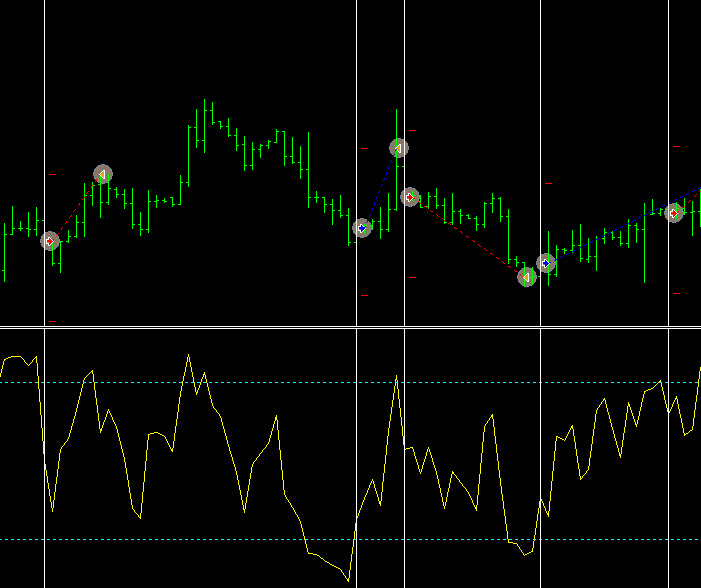

An example of trades using Strategy 2

Note that the same chart was used as for strategy 1

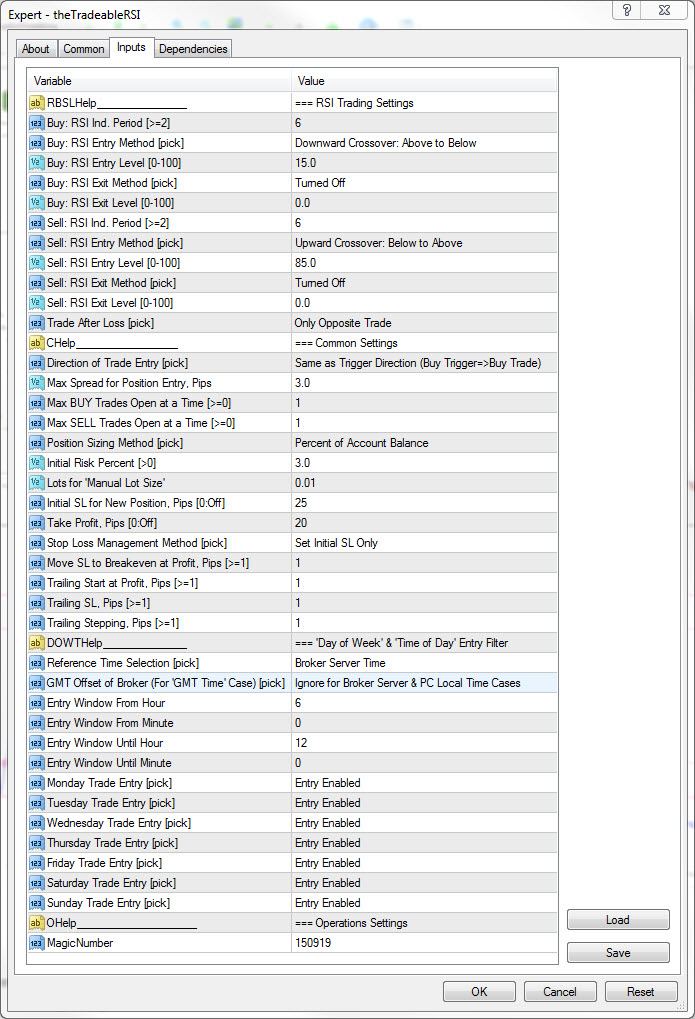

Possible scalping strategy 3

- Use the 15 minute charts and the EURUSD

- Use a RSI setting of 6 for both Buys and Sells

- Risk 3% per deal

- Buy when the RSI closes under the 15 level and to SELL when the RSI closes above the 85 level.

- Use a 25 pip stop and a 20 pip target

- Only trade the morning European session

An example of trades using Strategy 3

Note the missed trades that were outside of the selected trading time